Category: Articles

Showing page 17 of 68 with 2,440 matching results.

READ MORE

READ MOREThere’s no shortage of business owners who believe they can do it all on their own. A certain industrialist who recently bought a major social media network comes to mind. But he’s not alone. The list of so-called self-sufficient business owners is long.

READ MORE

READ MORELatest data from Aviva (January 2023) has again found the gender pension gap begins to widen significantly from the age of thirty-five, and there are still significant gaps between how much women pay into their pension compared to men.

READ MORE

READ MOREAre you in a lengthy legal battle and feeling financially strapped? It can be incredibly difficult to manage the financial burden of any type of litigation, especially if it’s a long-term case.

READ MORE

READ MOREWe live in a world where automation is taking over workplaces and handling tasks without any human intervention.

READ MORE

READ MOREEveryone messes up sometimes. You might do something small like accidentally sending a private message to all your co-workers. But other mistakes can hurt you, especially if you make a poor investment.

READ MORE

READ MOREBusiness owners often require external financing sources to sustain day-to-day operations. Such sources are necessary when proprietors need to procure funds to manage business operations.

READ MORE

READ MORESmall startups often need capital to grow. This financing can originate from various sources. Before you look for funds, you should have a solid command of business strategy and a clear vision of how to use your investment money to grow your business.

READ MORE

READ MOREBusiness financing can provide the necessary support to help your small business succeed and stay afloat. With numerous options available, some small business owners might feel overwhelmed by the sheer number of choices they are using to finance their business needs.

READ MORE

READ MOREThe global digital payments market is now estimated to be worth more than the car manufacturing sector, and is expected to reach USD$20 trillion by 2026. According to virtual payment card provider Lanistar, this extraordinary growth of some 24 percent per year is being driven by a combination of technological innovation along with changing expectations and spending habits among consumers.

READ MORE

READ MOREWith the end of the 2022/2023 financial year on 5 April nearly upon us, the experts at Perrys Chartered Accountants have put together a checklist of tax reliefs to make the most of before it’s too late.

READ MORE

READ MOREIf you’re just beginning the crazy and sweet journey into the entrepreneurship world, you’re probably overwhelmed with all the new challenges this sort of voyage brings on.

READ MORE

READ MORETax is a fundamental and inescapable part of life. It’s crucial in the big picture of society because it helps to pay for essential systems and processes such as healthcare, emergency services, infrastructure and much more.

READ MORE

READ MOREThe market experienced serious losses in 2022, but the tide is turning in 2023. Last month, investors were given a glimmer of hope for the beginning of a market recovery, which was up 6% since the beginning of the year. While investors are still experiencing high-interest rates, the potential for debt default, and the ongoing discussion of a recession in their minds, we are likely to see financial recovery over the course of the year.

READ MORE

READ MOREAccording to a study released by the Money Charity, the average total debt per UK household stood at £62,286 in June this year.

READ MORE

READ MOREAs we are in the midst of a cost of living crisis, the prospects for small business owners can seem relatively bleak. Now is the time for small businesses to scale back and cut down on any irrelevant costs before they grow - focusing on what will drive revenue and help them to succeed within their market.

READ MORE

READ MORESource advisors are professionals who provide insight and guidance to organizations on how they can use data sources in the most effective way. These people understand the nuances of data sources, including their advantages, limitations, and potential opportunities for improvement.

READ MORE

READ MOREWhat are some of the new wrinkles in this year's personal finance situation? For starters, home-based workers can get more of a tax deduction for many of their expenses. But even more important is the continuation of such manoeuvres as co-signing on student loans, higher limits on IRA contributions, and fresh tactics for getting the most out of grocery discounts.

READ MORE

READ MOREAs an entrepreneur, you want your company to succeed. However, having a solid idea or high-quality products for your startup company isn’t enough to achieve success. You must also be aware of the legal challenges of setting up a startup company.

READ MORE

READ MOREIn a recent survey from Paragon Bank suggested that the number of landlords planning to set up limited companies to purchase buy-to-let properties had increased by 50% from the first quarter of 2022 to the second. That’s the highest number of landlords in the last three years that have said they are thinking of using limited companies.

READ MORE

READ MORERetirement planning can be a daunting task, with so much to consider. One option to look into is investing in an annuity. Annuities are a way to guarantee a steady stream of income during retirement and can provide peace of mind for those looking to ensure their financial security.

READ MORE

READ MOREAs a financial advisor, it’s critical that you have a strategy for overcoming the competition. Without this, you’re likely to get lost in the crowd. And when that happens, growing your business becomes very difficult.

READ MORE

READ MOREAs businesses around the world face disruption with inflation pressures, the prospect of a recession, supply chain disruptions, and talent shortages, it is clear that challenges lie in the road ahead. In uncertain times, organisations often turn to cutbacks to reduce overhead costs and keep their head above water.

READ MORE

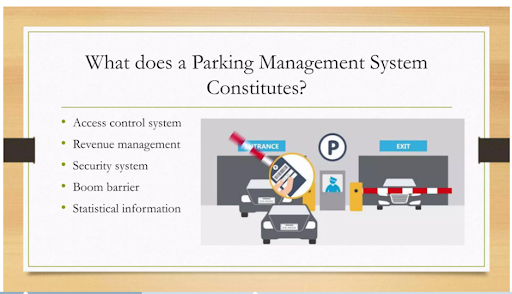

READ MOREThe development of parking technology has resulted in the widespread use of parking management systems (PMS) by both parking lot owners and customers. Nowadays, running a parking garage or lot with a PMS is possible.

READ MORE

READ MOREWorldwide, financial crime has grown to be a major concern. Every company wants to safeguard itself and lower the chance of falling victim to financial crime.

READ MORE

READ MOREWhen retirement is around the corner, you are probably thinking about a lot of different things. The most important part of retiring is money.

READ MORE

READ MOREFrom soaring petrol prices to the insanity of $10 heads of lettuce, we’ve all been feeling the impact of rising prices worldwide. As inflation hits a 40 year high of 9.1 and living expenses continue to rise, managing your personal finances has never been more crucial than it is today.

READ MORE

READ MORELove, romance and … taxes. It’s not the first thing that springs to mind when considering the perfect Valentine’s gift for your partner, but if you’re married, in a civil partnership, or even planning to get down on one knee, then there’s a range of tax reliefs available that you should be aware of.

READ MORE

READ MOREThe first step toward purchasing a house is usually saving for its down payment. Putting money aside for your future home may involve discipline.

READ MORE

READ MOREThe cybersecurity sector is expanding to match the digitalisation of companies across the globe. These new technological advancements bring an increased risk of criminal activity which needs to be combated. With this increase in demand for robust cybersecurity solutions, investors should seize the opportunity to diversify their portfolios with stocks in this area to benefit from market demands.

READ MORE

READ MOREGlobant, a digitally native company focused on reinventing businesses through innovative technology solutions, announced today that its Be Kind Tech Fund has invested $1 million in Polemix, the first platform to introduce Web3 technology to the world of ideas and opinions. The startup's mission is to upgrade how people support and oppose opinion leaders, disrupting the echo chambers cultivated by traditional social media platforms.

READ MORE

READ MOREIn the past several years, numerous cryptocurrencies have been introduced. The decentralized cryptocurrency Shiba Inu Coin came into being in 2020.

READ MORE

READ MOREAs the new year kicks off, you may be taking some time out to look at your finances, budget for a holiday later in the year, or you may even be thinking about buying a new home. If your plans involve taking out a loan of any kind, you may have come across the topic of your credit score - and this could have an impact if yours is less than attractive right now.

READ MORE

READ MOREBacktesting is a manual or systematic technique for assessing whether a trading strategy or concept was lucrative in the past.

READ MORE

READ MORETechnology has been playing a critical role in transforming business operations and led to a significant paradigm change in how business-specific software has grown over the years. Software solutions have become a critical component of modern businesses in this digital age.

READ MORE

READ MOREData privacy regulators affect how website owners and online businesses store and collect their cookie consent from website visitors. Every time you visit a website, you will see a request claiming that you need to deny or accept cookie usage.

READ MORE

READ MOREWhether you’re a trader or not, it’s no secret that all global financial markets are directly or indirectly interconnected. This is due to the globalisation of commerce as well as ease of access to financial markets which allows for copy trading to thrive as people look for the best stocks to provide a large return […]