Category: Finance/Wealth Management

Showing page 1 of 6 with 205 matching results.

READ MORE

READ MOREWhy “More Leads” Isn’t Growth Anymore More lead volume hides declining revenue probability due to the “Threshold Trap.” When a minimum of qualified leads is prioritized, it incentivizes quantity at minimum quality, not above. This fails because 60–70% of revenue usually comes from the top 20–30% of high-fit leads. A volume-first approach creates a feedback […]

READ MORE

READ MOREThe thing with culture is that it takes time to build. Your organizational DNA doesn’t happen overnight. It develops, grows and strengthens through consistent actions and shared values. This is how a strong organizational culture highly impacts credit union performance.

READ MORE

READ MOREDelaware statutory trusts (DSTs) are a popular option for investors seeking passive real estate income and 1031 exchange tax deferral. However, like any real estate investment, it’s essential to find strategies that minimise risk. Understanding how DSTs work and exploring reputable firms can help potential investors invest in DSTs safely while enjoying the benefits. What […]

READ MORE

READ MOREEvery founder knows that hollow, knot-in-the-stomach feeling when the spreadsheet indicates the runway is shrinking faster than the customer base is growing. In the Driftless Region, one name keeps surfacing when people talk about practical, people-first business guidance: Vikki Nicolai La Crosse. She’s a reminder to founders that spending limits don’t kill ambition; they’re the […]

READ MORE

READ MOREAs winter heating bills climb and the cost of everyday treats continue to rise, new data from flexible workspace operator beyond shows that hybrid workers could save over £300 a month simply by going in 3 days a week and making full use of the complimentary perks already included in their workspace membership.

READ MORE

READ MORENumbers tell stories. Sometimes they whisper. Other times they shout. Right now, the surge in auto refinancing is absolutely yelling. We are seeing a wave of borrowers rushing to swap their old loans for fresh ones. This is not random behavior. It is a clear signal. The question is what exactly it reveals about the […]

READ MORE

READ MORERecent reporting in The Times points to a striking shift in how women are investing.

READ MORE

READ MORECompliance technology empowers organisations to navigate complex regulations with precision and efficiency. Adopting proven strategies ensures proactive management of risks while streamlining operations for stress-free regulatory compliance early in the process. Embrace AI-Driven Automation AI brings compliance into a predictive, clever ecosystem, where machine learning algorithms analyse trillions of transactions, access patterns, and internal control […]

READ MORE

READ MOREMobile Trading Tools for Real-Time Executive Insight Executives today operate across multiple markets, time zones, and regulatory environments, often making critical decisions far from traditional workstations. In this landscape, mobile trading technology has moved beyond simple on-the-go access to become an essential layer of financial intelligence. Its strategic purpose is to deliver continuous visibility, reinforce […]

READ MORE

READ MOREIn this exclusive interview Alok Sama shares his views on innovation, investment decision-making and the leadership qualities that drive success in finance, technology and beyond.

READ MORE

READ MOREA Workforce Without Borders Remote work and location-independent lifestyles are no longer fringe movements. Millions of professionals now work from cafés, co-working spaces, and temporary homes across continents. This global shift has quietly exposed the limitations of traditional banking systems—systems built for static lives, local currencies, and predictable routines. As a result, remote workers and […]

READ MORE

READ MOREA death in the family can trigger bank freezes, title searches, and a sudden rush for documents. When the will surprises people, the grief quickly turns into questions about fairness and intent. Those questions often land on an executor who must act fast while staying neutral daily. Will litigation starts when someone challenges a will, […]

READ MORE

READ MOREMost of us start a financial plan with good intentions. We want to save more, stress less, and feel confident about the future. But sticking to that plan? That’s often the most challenging part. Life gets busy, priorities change, and it’s easy to drift off course without even realising it. The truth is, having a […]

READ MORE

READ MOREKey Highlights Debt consolidation loans can simplify finances by combining multiple debts into one fixed repayment. They’re most effective when interest rates are high or repayments are spread across several lenders. It’s important to assess whether consolidation improves your financial position in the long term. Choosing the right loan terms and lender can turn a […]

READ MORE

READ MORESlow, steady individual retirement account (IRA) growth can feel limiting when you try to build a more dynamic retirement strategy. Exploring where you can find a reliable IRA custodian for private equity investments can help you overcome this hindrance.

READ MORE

READ MOREA Delaware statutory trust (DST) has become a popular investment option because it allows members of an investor pool to hold an undivided fractional interest in real estate.

READ MORE

READ MOREGolden Visa Program Reshapes Bulgaria’s Investment Market As part of its strategy to strengthen and modernise the country’s capital market, the Bulgarian government has introduced a revamped Bulgaria Golden Visa program. The updated framework includes a fund investment option similar to the Portugal Golden Visa but with two major advantages: for the same investment of […]

READ MORE

READ MOREBreaking down the mental processes that drive overspending enables financial professionals to help their clients rewire their habits for lifelong stability.

READ MORE

READ MOREThe traditional investment narrative presents a stark choice: pursue growth through capital appreciation or seek income through dividends, but don’t expect both. Growth investors accept minimal current income, betting on future share price increases. Income investors accept limited capital growth, prioritising reliable dividend payments. This binary thinking has dominated investment strategy for decades, forcing investors […]

READ MORE

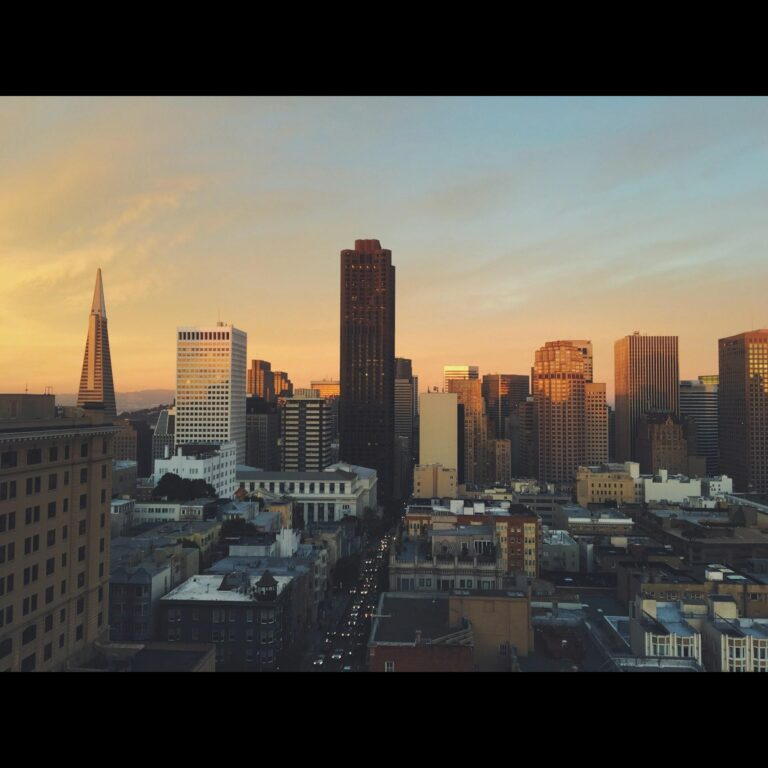

READ MOREMost private equity professionals will tell you there’s no single formula for success, but JP Conte’s journey from modest beginnings to managing partner of a San Francisco-based private equity firm offers a blueprint worth studying. Over several decades, he has built a reputation for transforming mid-market companies while maintaining an unwavering commitment to mentorship and […]

READ MORE

READ MORESilver has always been the “quiet achiever” of the precious metals world — overshadowed by gold yet consistently valuable, wildly versatile, and often dramatically undervalued. But in 2026, silver coins aren’t just a traditional store of wealth… they’re one of the most strategically positioned assets for investors looking to hedge risk and ride long-term growth. […]

READ MORE

READ MOREFree Making Tax Digital software for Landlords: What Changes and What to Do Now GetGround’s free HMRC-recognised software ensures landlords understand MTD for ITSA phases, thresholds, and the practical requirements of digital records and quarterly submissions. Making Tax Digital for landlords represents the largest structural change to property tax reporting in UK history. From April […]

READ MORE

READ MOREThe demand for alternative investment opportunities is on the rise, driven by a desire for stronger returns from investment portfolios. At the centre of this shift is New Capital Link, an award-winning alternative investment firm acting as an introducer to asset-backed investment opportunities available to ultra-high-net-worth and high-net-worth individuals around the world. We took a closer look at the firm’s superlative solutions below, following its recent recognition in the Investment Excellence Awards 2025.

READ MORE

READ MOREIn today’s fast-moving business world, leadership requires more than instinct and experience. It demands precision, foresight, and the ability to translate complex financial data into an actionable strategy. As organisations face mounting financial challenges and global competition, leaders with both financial literacy and strategic agility have become indispensable. This is where professionals with an online […]

READ MORE

READ MOREAs many businesses shut stores and battle the current economic elements, the Amazon accountants Archimedia Accounts have provided insight into the impact of store closures on businesses financially, exploring the positives and negatives of these shutdowns.

READ MORE

READ MOREWealth brings options, influence and complexity. Families who built fortunes often juggle operating companies, concentrated equity, trust, real estate and cross-border lives. The challenge is avoiding unforced errors that compound over time.

READ MORE

READ MOREFor many businesses in 2025, the decision to purchase commercial property isn’t just about location and square footage anymore - it’s become a strategic move that can offer a range of financial, operational and long-term advantages over renting.

READ MORE

READ MOREWhen digital interactions define the pace of business, latency is a central factor in competitiveness. This article explores how latency shapes customer experience, operational efficiency, and financial performance, breaking down its technical components, sector-specific impacts, and the strategies organizations use to minimize it. The Millisecond Economy Every digital transaction, click, or stream faces a natural […]

READ MORE

READ MORECredit: drobotdean Via Freepik For decades, financial advisors have warned that hiding in cash is not the fortress it appears to be. In today’s climate of persistent inflation and shifting interest rates, that warning is louder than ever. As noted in the Financial Times, wealth managers caution that “over-reliance on cash” might seem safe, but […]

READ MORE

READ MOREHow Digital Marketing Drives Growth for Finance and Professional Services Firms The finance sector faces a paradox. Whilst financial professionals excel at managing wealth and navigating complex markets, many struggle to attract new clients in an increasingly digital landscape. Traditional networking and referrals still matter, but prospective clients now begin their search for financial advisors, […]

READ MORE

READ MOREBuilding lasting financial security rarely happens instantly. For most of us, it’s a gradual process, a little bit at a time, that grows through steady saving and smart investing. Chasing quick riches might sound exciting, but that approach often backfires, leading to big risks that can hurt your long-term goals. Instead, taking a patient, step-by-step […]

READ MORE

READ MOREWork Hard, Relax Harder: Stress-Free Habits of Financially Successful People High performance and deep rest go hand in hand for many people who have built lasting financial success. You already know the sensation of pushing too hard without recovering: you end up drained, unfocused and far less effective than you intended. Recent data show that […]

READ MORE

READ MOREIn this article, experts from the fintech development company Itransition explore the common pitfalls that tech companies face when implementing financial modeling tools and building financial models, as well as share some practical tips to navigate them.

READ MORE

READ MORELiquidity in Volatile Markets: How Small-Cap Tokens Behave Cryptocurrency markets are known for their sudden swings, and small-cap tokens often feel these fluctuations the most. Their price can move sharply in both directions because they trade with less volume and fewer buyers compared to large tokens like Bitcoin or Ethereum. For investors, this makes liquidity […]

READ MORE

READ MOREIt takes decades of sound planning and good decisions to enjoy a comfortable retirement. Unfortunately, even the best of us can make mistakes that impact our financial lives in our golden years. It’s therefore essential to know about those common mistakes and their consequences if you don’t want your retirement fantasies to become financial catastrophes. […]

READ MORE

READ MORELuxury wedding planners, Siobhan Craven Robbins, and Andri Benson have also offered their expert guidance on keeping costs down while planning the perfect day.