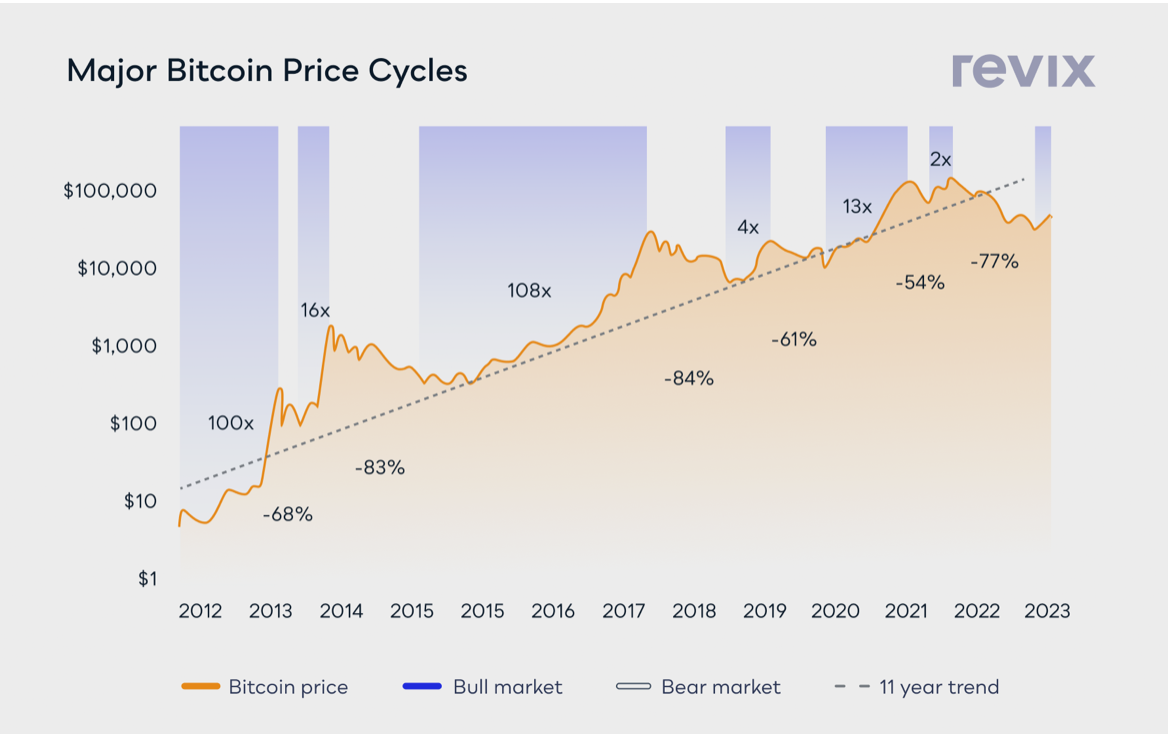

While history doesn’t repeat itself exactly, it often rhymes. Historical patterns in the cryptocurrency market offer insights into its behavior over time. The chart below displays various episodes of price appreciation. In late 2013, Bitcoin surpassed the $1,000 mark, followed by a decline in subsequent years, influenced by factors such as regulatory concerns.

Bitcoin’s resilience is showcased by its recurring recoveries and attainment of new highs. For instance, in 2017, Bitcoin reached close to $20,000. This peak was succeeded by a downturn in 2018, resulting in a significant drop in prices.

In 2020, Bitcoin observed another notable price increase, appreciating 13-fold during this period. Multiple elements contributed to this rise, including heightened institutional engagement, a worldwide pandemic steering investors towards unconventional assets, and an emerging view of Bitcoin as a prospective store of value.

Peering into Bitcoin’s future price is a bit like trying to predict the weather; there are indicators, but there’s no certainty. Here are 10 signs to watch for that hint at a potential uptrend:

- Busy Markets: Think of this as the ‘chatter’ in a crowded room. When trading volume goes up, it means more Bitcoins are being bought and sold, suggesting growing interest.

- Good News Parade: Big announcements or events that favor Bitcoin can be like a marching band leading a charge. They can spark a surge in demand and price.

- Chart Tools and Toys: Some traders rely on tools like MACD and RSI. When these turn positive, it can hint at Bitcoin feeling bullish.

- Reading the Charts: analyzing japanese candlestick patterns can give hints about where the price might head next. It’s a bit of an art and a science.

- Bitcoin’s Resilience: If Bitcoin shines even when the news isn’t great, or if it outperforms its crypto cousins, it might be hinting at a positive shift in sentiment.

- Big Money’s Gaze: When heavyweight financial institutions start throwing glances (or cash) at Bitcoin, it’s worth paying attention. Their involvement can lend credibility and drive demand.

- Epic Breakouts: Picture Bitcoin as an athlete leaping over hurdles. If it jumps over a price point (especially a tough one) with strong volume behind it, it might be gearing up for a marathon.

- Shorts Cooling Their Heels: If fewer people are betting against Bitcoin (short selling), there’s less downward pressure on its price.

- Market’s Mood Ring: The overall sentiment in the broader market can be a bellwether. If traders and investors are generally optimistic, Bitcoin might catch the enthusiasm wave.

- Economic Sun and Clouds: Economic data and policies can act like weather conditions for assets. When the forecast is favorable, assets like Bitcoin could see a boost in demand.

Remember, predicting Bitcoin is never an exact science, but understanding these signals can help steer your investment ship through its often choppy waters.”

What about other coins?

Bitcoin leads the crypto industry, but during ‘altcoin seasons’, altcoins can surpass its returns. The most notable altcoin season was around 2021, with extreme growth in various altcoins. For instance, Vitalik earned $4.3 million from a $25,000 Dogecoin investment.

Most altcoins are seen as speculative, with a likely 90-95% failure rate. However, in an altcoin season, portfolio size matters less. Whether holding 5 or 50 altcoins, significant growth is common. Underperformers can be sold, retaining potential winners.

“Some people say you don’t need many altcoins, and only a handful of ‘good’ altcoins will suffice. I disagree. During altcoin season, the number of altcoins in your portfolio is less relevant. Regardless of whether you hold 5 or 50 altcoins, your portfolio is likely to experience substantial growth. At that point, you can sell underperforming altcoins or projects that did not meet expectations while still holding onto the ones you believe in until their value reaches either zero or infinity.”

Currently, it’s not an altcoin season, but it might be time to explore certain coins or even gamble on a potential 100x coin.

Cryptocurrencies are characterized by their volatility and uncertainty. Historically, the market has seen periods of significant price appreciation. Although external factors, such as regulatory changes, can impact the price of assets like Bitcoin, it often recovers and achieves new highs.

It’s not feasible to determine the precise onset of a future bull market. However, you can implement certain strategies to maximize potential gains during such periods:

Steady Investments (DCA): It’s like setting a monthly subscription. You spend a set amount on crypto, regardless of its current price. Over time, this helps smooth out the bumps, giving you an average ticket price.

Crypto Toolkits: There are some fancy tools like MACD and RSI that give hints about market turns. Imagine them as weather forecasts; if RSI says it’s ‘overbought’ and MACD nods in agreement, it’s probably sunny days ahead.

Spreading Your Bets (Altcoins): Sure, Bitcoin’s the big name, but there are other rides in the park. Sometimes, these lesser-known rides (altcoins) can offer faster thrills. Just be sure to read the safety guidelines, because not all are built the same.

In the cryptocurrency market, it’s essential to base decisions on data and trends rather than speculative influences. Proper research and strategy implementation are crucial for potential success.