Knowing how to manage your income each month is essential – it gives you a clear idea of where your money is going, and how much you have left to spend. But what do you do when the money that you have left over is not enough to get you to your next pay check? Payday loans bad credit are there to help you if you are faced with an emergency, however, there are ways that you can free up your cash flow and increase your spending budget.

What is a budget & why is it important?

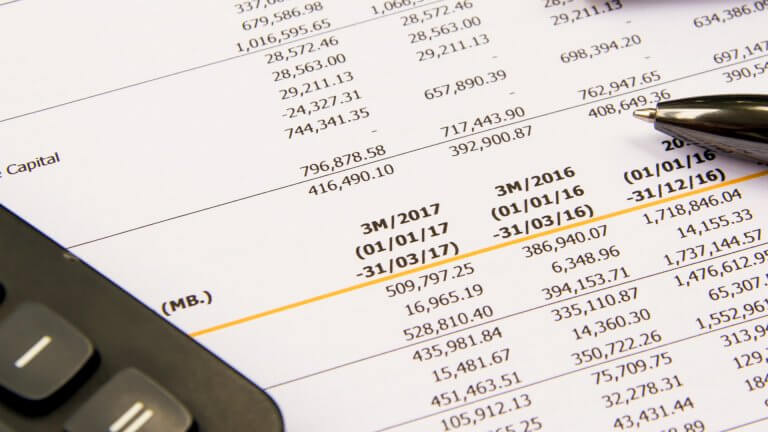

If you’re thinking about getting to know your money a little better as a way of managing your finances, a budget is the best place to start. Usually, a monthly budget works best – you take the amount of income you get and subtract the number of outgoings throughout the month. You should make sure you categorise your outgoings to help you identify if you’re overspending. Your primary outgoings should be rent, mortgage and car payments, as well as any additional energy bills, debt payments and food shopping. The rest are known as secondary expenses. When creating a budget, you will learn how much you have left over to work with for the rest of the month.

Budgets are essential when it comes to reaching your financial goals. Having an overview of your spending means that you can see where your money is going and you can identify areas that you may be overspending, so you can make changes. These changes allow you to save or pay off debt – no matter if your money goals are big or small, a budget can help you to achieve them. Generally, they help you to get to know your finances, and keep you out of difficulty.

Ways to increase monthly budget

If you’ve worked out a budget, there is a chance that the money you’re left with after your primary expenses may not be as much as you’d hoped – but don’t worry, if you think you need more money to live comfortably throughout the month, there are a few ways that you can free up some extra cash – we will look at these in more detail below.

Pay off debt

The best place to start is by paying off your debt. Debt is money tied up in paying previous lenders that you could be putting towards other things. It is essential that you pay off your debt in full as soon as you can. And although this may seem counterintuitive, you’ll be spending more money by paying down your debt, it is better in the long run so that you can benefit from an increase in cash flow when your debt is finally gone.

Make cutbacks

One of the best things about a budget, as we previously mentioned, is the fact that you can identify where you are spending your money and make changes when needed. For example, getting to know your outgoings means you’ll notice any subscriptions or memberships that you don’t use anymore that you should cancel. Taking the time to manage these things means an increase in your cash flow and having more money to spend elsewhere.

Reduce impulse buying

If you’re not familiar with impulse buying, you may not realise that you’re doing it! Impulse buying is purchasing things that you don’t need because they’re a good price, or simply because they caught your eye in the supermarket. You should try and refrain from doing this if you are hoping to increase the amount of money you have to spend each month. Adding extra items to your food shop, or clothes shopping when you’re bored could add up to a large amount each month, that you could use for something else! Try and take a list with you when shopping anywhere, not just the supermarket, so that you’re not tempted to deviate and spend more money.

Increase income

This point seems obvious, if you are looking to increase your monthly budget, you can start by increasing your monthly income. You could look for another job that pays more, ask your current employer for a pay rise in line with a good performance, or you could start working on a side project. If you have a hobby that you enjoy, why not see if you can make money from it?