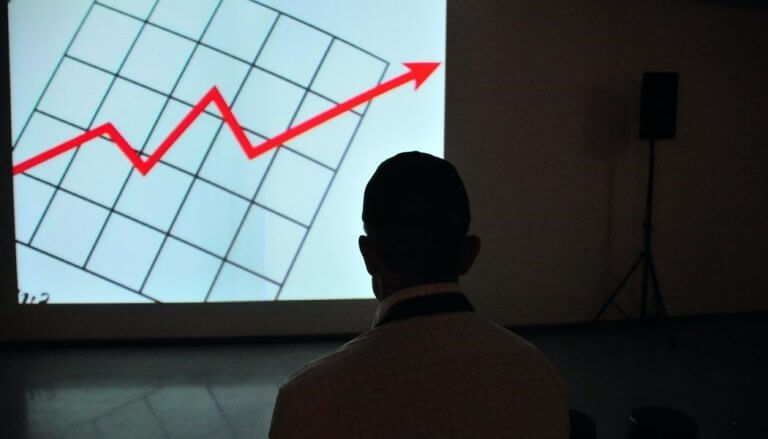

Insolvency may just be the biggest threat to any business, so what makes a business prone to this and what measures can be taken to avoid it?

Business insolvency poses a significant threat to the stability and longevity of companies across various sectors. Understanding the key risk factors that contribute to insolvency and taking proactive measures to mitigate these risks are essential steps in safeguarding your business’ future.

A specialised insolvency law firm can provide tailored advice and solutions aligned with your company’s specific needs and circumstances. But, what are the basics you need to know first? Take a look…

Understanding Insolvency: Definitions and Key Concepts

Insolvency occurs when a business no longer has the financial means to pay its debts as they fall due. It’s a situation that can arise from various internal and external factors, ranging from poor cash flow management to sudden market downturns.

Understanding the different aspects of insolvency, including its legal implications and potential outcomes, forms the foundation for implementing effective preventative strategies.

Key Risk Factors Leading to Business Insolvency

Several factors can increase a business’ risk of becoming insolvent. Recognising these early on is critical to taking timely action:

- Poor cash flow management: inadequate tracking and control of cash flow can lead to a financial shortfall, making it challenging to meet obligations.

- Excessive debt: over-reliance on borrowing can burden a business with unsustainable debt repayments.

- Market competition and changes: failure to adapt to market trends and increased competition can erode profit margins.

- Legal and regulatory changes: new laws and regulations can impose additional costs or barriers to operation.

Proactive Measures to Prevent Insolvency

Preventing insolvency requires a proactive approach to financial management and strategic planning. Here are several measures businesses can take to protect themselves:

- Improve cash flow management: regularly review and optimise your cash flow processes to ensure you have sufficient funds to cover your obligations.

- Reduce and manage debt: evaluate your borrowing and ensure that any debt taken on is sustainable and aligned with your business’ growth objectives.

- Adapt to market changes: stay informed about market trends and consumer preferences to adjust your business model and offerings accordingly.

- Compliance and risk management: keep abreast of legal and regulatory changes affecting your industry and implement compliance and risk management strategies.

Engaging with professional advisors can provide valuable insights and strategies for navigating these challenges effectively. For example, learning about insolvency prevention and second-chance strategies within the EU can offer new perspectives and solutions tailored to businesses operating within this jurisdiction.

Moreover, effective use of technology can significantly aid in the early detection of financial distress signals, enabling businesses to act swiftly to rectify issues before they escalate into insolvency. Investing in financial management software and tools can provide real-time insights into your financial health, facilitating better decision-making.

Creating a Culture of Financial Awareness

Creating a culture of financial awareness within your organisation is another crucial step in preventing insolvency. This involves educating your team about the importance of financial health and the role they play in maintaining it.

Regular training sessions, workshops, and seminars can keep your staff informed about financial management practices, encouraging proactive identification and resolution of issues that could lead to insolvency.

Legal Framework and Support Systems to Avoid Insolvency

Understanding the legal framework surrounding insolvency is crucial for taking appropriate measures when a business faces financial distress. Different jurisdictions have various laws and support systems designed to help businesses navigate insolvency proceedings.

For instance, the HMRC’s debt restructuring guidance offers a way for businesses to restructure their debts while continuing their operations. Familiarising yourself with these legal structures and seeking expert advice can help mitigate the impact of insolvency.

Additionally, leveraging support systems such as business mentorship programs, financial counselling services, and government assistance can provide the necessary guidance and resources to overcome financial challenges. These support systems are often underutilised but can make a significant difference in steering your business away from insolvency.

Avoiding Business Insolvency is Key

Preventing business insolvency is a multifaceted challenge that requires a comprehensive understanding of risk factors and the implementation of proactive measures. By improving cash flow management, reducing and managing debt, adapting to market changes, and ensuring compliance with legal and regulatory requirements, businesses can significantly reduce their risk of insolvency. Additionally, leveraging technology, understanding the legal framework, and creating a culture of financial awareness are pivotal in navigating the complexities of financial distress.

For businesses facing financial difficulties, exploring resources and support systems such as the prevention and management of corporate insolvencies report can offer valuable insights and guidance. Remember, the key to preventing insolvency lies in early detection, strategic planning, and the willingness to seek professional advice and support when necessary. By adopting these strategies, businesses can safeguard their future and build a resilient foundation for long-term success.

Please be advised that this article is for general informational purposes only, and should not be used as a substitute for advice from a trained financial professional. Be sure to consult a financial professional for advice on business insolvency. We are not liable for risks or issues associated with using or acting upon the information on this site.