An accountancy career is, generally speaking, a stable and lucrative one, regardless of which accounting area you go into. With that being said, there are certainly some accounting jobs that have a higher scope for career development as well as a higher average salary. Many of the top accounting jobs require extensive training and certification, as well as at the very least a bachelor’s degree, if not a master’s degree in accounting. But they are well worth the time and effort put into obtaining them and accounting graduates are in a good position to obtain the best accounting jobs. Some accounting jobs will involve working in financial departments of large organisations, whereas others will see you working for an accounting firm with clients (individual or companies). Let’s take a look at the top five accounting careers.

1) Chief financial officer

A chief financial officer (CFO) is the highest financial role available in a company and the third-highest role overall. The CFO is responsible for the financial health of the company, business strategy, risk management, as well as financial and business decision-making. Rachel Dooley from Auditox Accountancy once had this title before going solo and her role was twofold. She was ultimately responsible for the financial management and financial reporting of the finance team, and this can include ensuring that financial reporting is compliant and accurate. She was also responsible for communicating with the board of directors and department heads to advise about business and financial matters.

The average salary in the UK for a CFO, according to Payscale, is £52, 000 – £172,000, and can include a base salary as well as bonuses and profit-sharing in the company. This is arguably the most lucrative of the accounting careers, which of course makes it extremely competitive to get into. A typical route into becoming a CFO would be a bachelor’s degree and a master’s degree in accounting, as well as becoming a certified public accountant.

2) Financial controller

A financial controller is a senior manager in charge of the accounting department. Their role can vary depending on the size of the company, but they can include ensuring the compliance of financial records and financial statements, overseeing the accounting activity of the accounting department, and in some cases using financial data to advise about strategic business decision making. Using an SEO company that has a CFO as an example, the financial controller will report directly to them. And becoming a financial controller can be a stepping stone into becoming a CFO. In a smaller SEO company, a financial controller might be involved in preparing financial reports, as well as to prepare budget reports and cash flow statements, and they may also be responsible for ensuring that tax returns are accurate and compliant.

The average salary in the UK for a financial controller, according to Payscale, is £31,000 – £77,000 and can include a base salary as well as bonuses and profit-sharing. A relevant degree in accountancy, maths, business, or finance is required to become a financial controller, as well as an accountancy qualification.

3) Financial accountant

A financial accountant is responsible for preparing financial statements and financial reports to demonstrate the performance of the company and to help manage finances. They also take an active role in the company’s financial accounts and financial records and often will also be tasked with ensuring that financial practices within the company are as efficient as possible.

The average salary of a financial accountant, according to Payscale, is £27,000 – £56,000, including bonuses and profit sharing. To reach an accounting career as a financial accountant, you will usually need to have a chartered accountancy qualification.

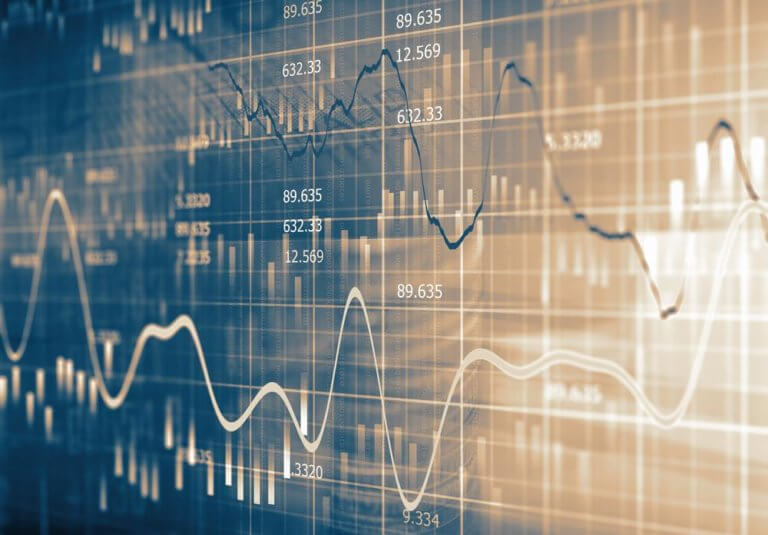

4) Financial analyst

Financial analysts are accounting professionals that are tasked with the role of analysing financial reports and data and applying that financial information to advise about financial strategies and financial decisions within a company. They may also analyze budgets and help to develop strategies to make them more efficient. Financial analysts can work for any business company, but they are also often hired by financial institutions, and they are often involved in investment decisions and advising about financial risks and benefits of business decisions.

The average UK salary of a financial analyst, according to Payscale, is £23,000 – £57,000, including bonuses and profit sharing. A bachelor’s degree in a maths or finance-related field, as well as a master’s degree, can help to get a job as a financial analyst, as can a certified accountancy qualification.

5) Tax accountants

Tax accountants are specialised in advising companies about their taxes. This can include tax compliance as well as tax liability. They are often tasked with ensuring that the company, or individual, isn’t paying tax that they aren’t liable for, and for ensuring that all tax records are compliant with relevant tax laws. Tax accountants can help their clients to make financial decisions by informing them of their tax liability, and they tend to be busier during the tax period of the year. Tax accounts can be attached to an organization’s accounting department or they can work for accounting firms that have private clients.

The average UK salary for tax accountants, according to Payscale, is £17,000 – £49,000, including any bonuses. To become a tax accountant, an undergraduate degree in accounting is desirable as well as an accountancy certification.

Other top accountancy jobs

Forensic accountants

Financial manager

Accounting managers

Forensic accountant

Accounts payable specialist

Public accountant

Cost accountant

External or internal auditors

The bottom line

There is a huge variety of accounting careers in all areas of the financial industry. Deciding on which accountancy career is for you depends partly on where you want to go in terms of academic qualifications, what your own necessary skills are (including soft skills), and how much you think you would be fulfilled by the role itself. For most accounting jobs, you will need to have relevant qualifications but these can be obtained through a variety of different routes.